How popular is cyber cover in an age of increasing online risk?

With rapid technology expansion comes the heightened risk of cybersecurity attacks. As scams and breaches become more sophisticated, businesses and individuals must actively take steps to mitigate cyber-threats and guard against risk. In conjunction with Safer Internet Day on 7th February, we explore consumer sentiment on the issue and the role that insurers can play to help people protect themselves.

-

76.8% are conscious about protection of online data, identity and assets

Greater connectivity, access to information and online services through the internet simultaneously brings huge benefits and huge risks. However, it appears that the scale of the risk is growing.

Cybersecurity specialist SonicWall’s Cyber Threat Report shows that ransomware attacks were up 105% in 2021, with threat researchers seeing more than 623.3 million attacks globally. [1] Encrypted threats increased by 167%, with 10.1 million attacks recorded. Cybersecurity Ventures expects global cybercrime costs to grow by 15% per year over the next five years, reaching $10.5 trillion USD annually by 2025, up from $3 trillion USD in 2015. [2] The cost of criminal activity online is not insignificant, to say the least.

Commercial cyber protection

Cyber insurance has generally been a product for corporations and business enterprise. It has been available since the late 1990s, coinciding with the rise in dot.com businesses. Since then, the development and extending reach of the internet has shown us that cyber risk is difficult to understand, problematic to predict, and characterised by a continually changing threat environment. What is most concerning is that cyber threats are only more likely to grow.

Attempting to keep pace, cyber protection has evolved considerably, with policies today providing a suite of risk management and limitation tools alongside first- and third-party liability cover to mitigate losses as best as possible. We are also now seeing similar product developments to protect consumers and not just commercial entities.

-

105% more ransomware attacks in 2021

Personal protection

Facilitated by technological advancements, the way we use the internet has changed. With the lockdowns of the pandemic, our reliance and dependence on the internet has accelerated significantly. Many people now work from home, school from home and shop from home. From managing our finances, consulting with our doctors, watching television shows, or video calling distant family, we are more online than we are off it. While we browse the web, we produce significant amounts of data, complete transactions with our credit cards and share private details of our personal lives on social media. Many people are reliant on the internet to earn their living from content production and social media influencing, whilst others trade digital assets such as cryptocurrencies and NFTs. Regrettably, this increased use further exposes consumers to scammers and hackers and puts our personal and identity data at risk of theft, breaches, and extortion.

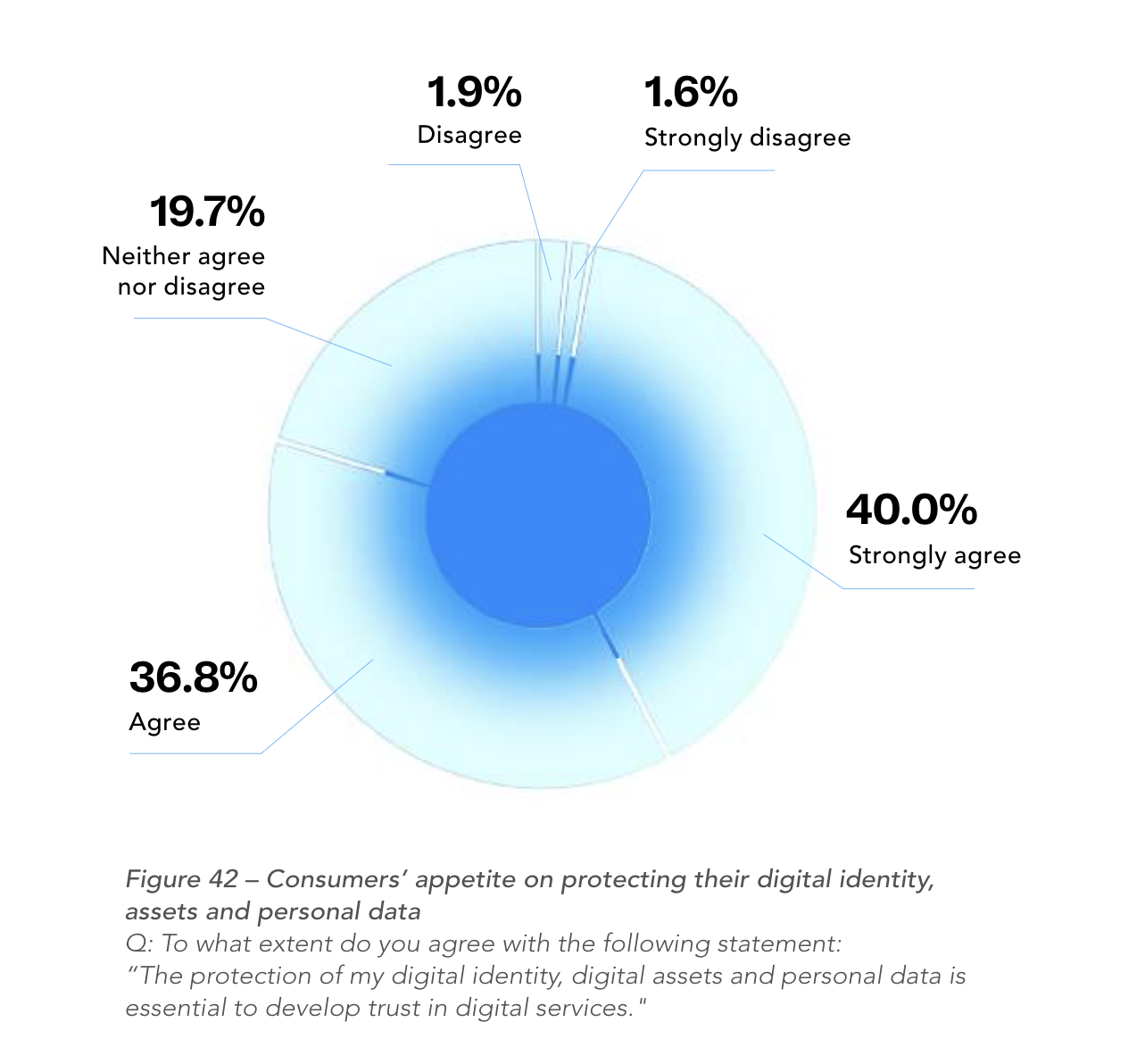

Gauging consumer appetite for personal protection, we found that 40% of respondents strongly agree with the statement “The protection of my digital identity, digital assets and personal data is essential to develop trust in digital services.", with a further 36.8% agreeing. Of the remainder, just 3.5% disagree or strongly disagree (Figure 42).

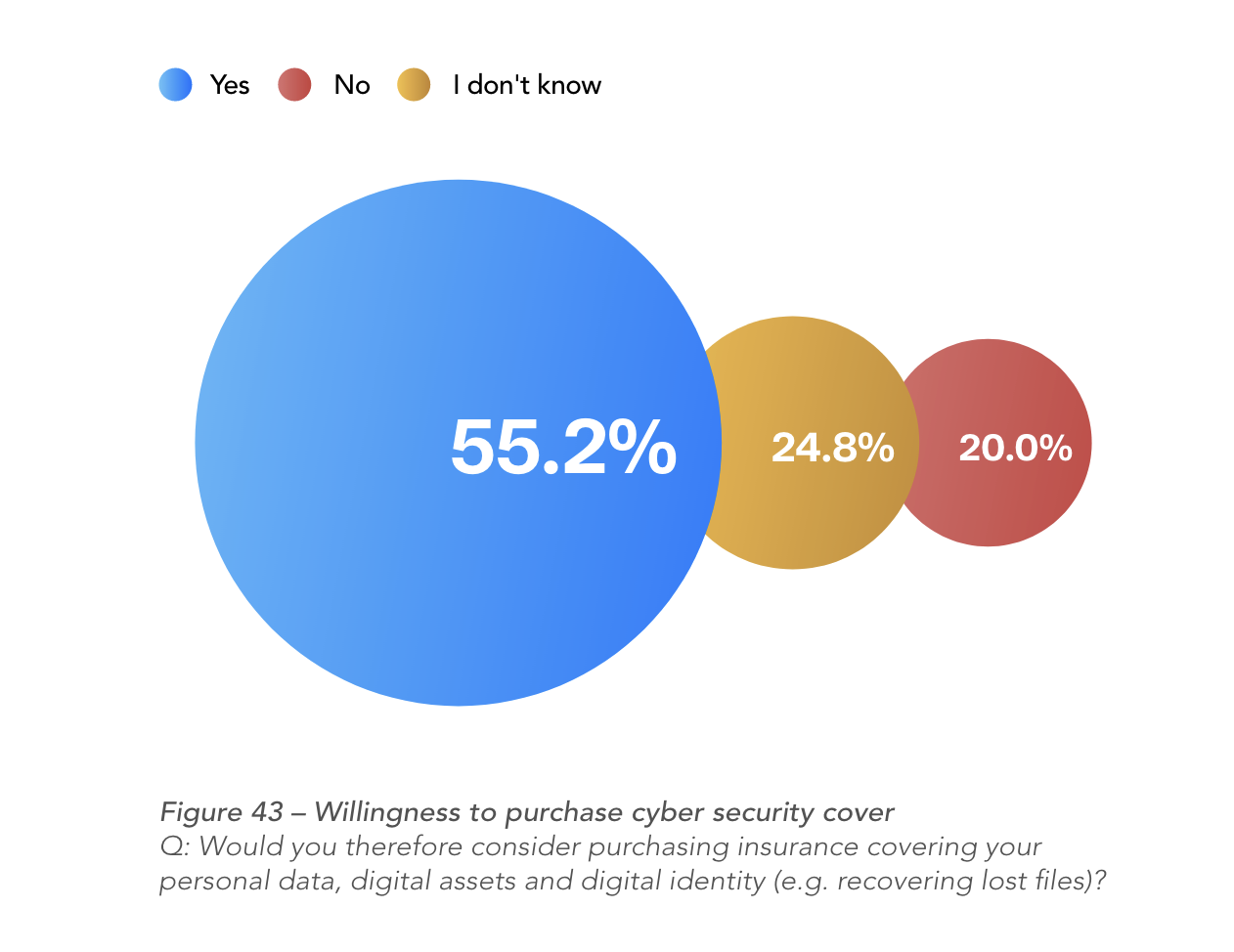

Our study indicates that 55.2% of the 76.8% of respondents who either agree or strongly agree with the statement said they would consider purchasing a cybersecurity cover. This coincides with a study conducted by Accenture [3] that found that 76% of consumers would welcome assistance from their insurer in dealing with cybersecurity threats and 53% would be interested in home cybersecurity where premiums are tied to using the latest virus protection (Figure 43). Combined, these findings indicate that there is a strong appetite for some form of personal lines cyber insurance.

Personal cyber insurance isn’t an easy pitch for insurers and is difficult to price, especially as they have much less control over the cybersecurity a consumer has in place or their awareness of the risks. Consequently, it’s often sold as an add-on to household insurance or as part of a high-net worth product.

But given the demand and the increased risk, insurers may want to consider how they bring cyber insurance to the consumer market. Insurers need to create wider awareness of personal cyber insurance, educate consumers on the threats of online activity and the benefits of protection. Existing cover is usually sold as an add-on to home insurance, but there is potential to develop new propositions.

Building connections

As technology advances, the connected vehicle and home will become commonplace, delivering benefits that could range from improved energy efficiencies through to never missing a favourite television programme or running out of milk.

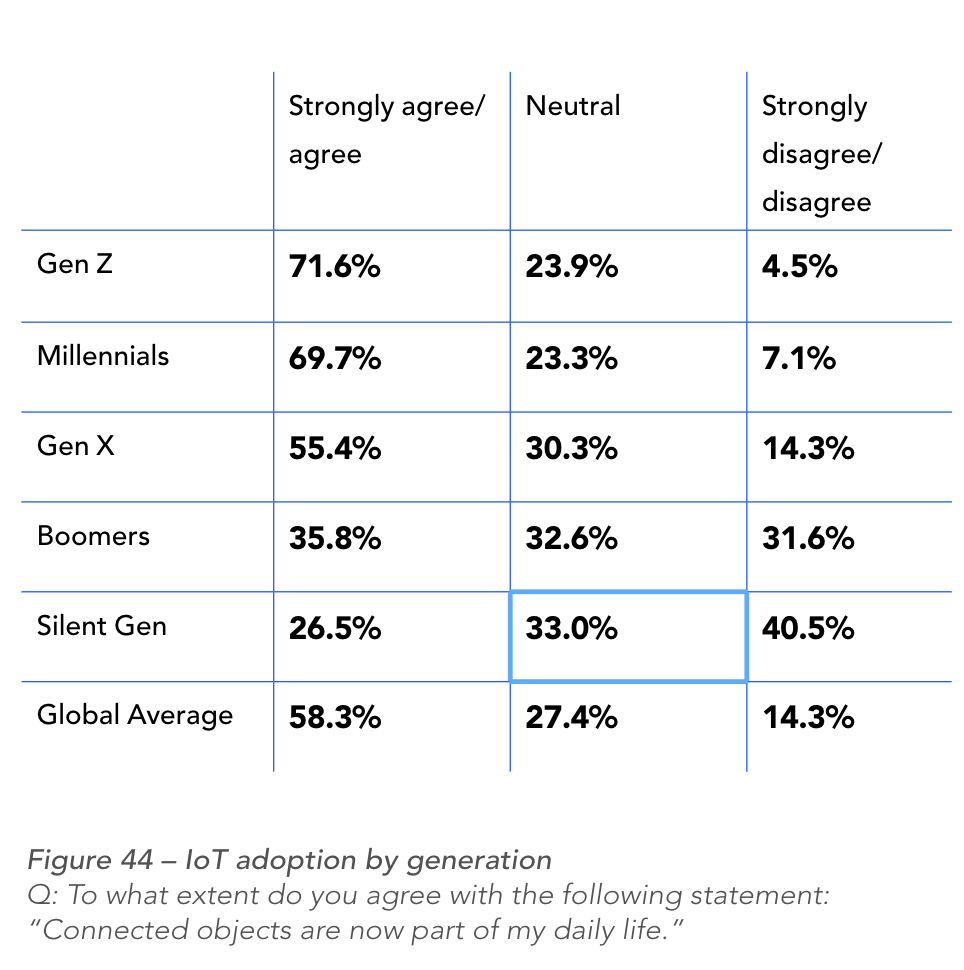

Research by Mordor Intelligence [4] indicates that the Internet of Things market is expected to grow at a rate of 10.5% a year between 2022 and 2027. As shown in Figure 44, more than half of respondents think that ‘connected objects are now part of their daily lives’.

Age matters, with 71.6% of Gen Z respondents strongly agreeing with the statement. This falls steadily through the generations to 35.8% among Boomers and 26.5% among the Silent Generation.

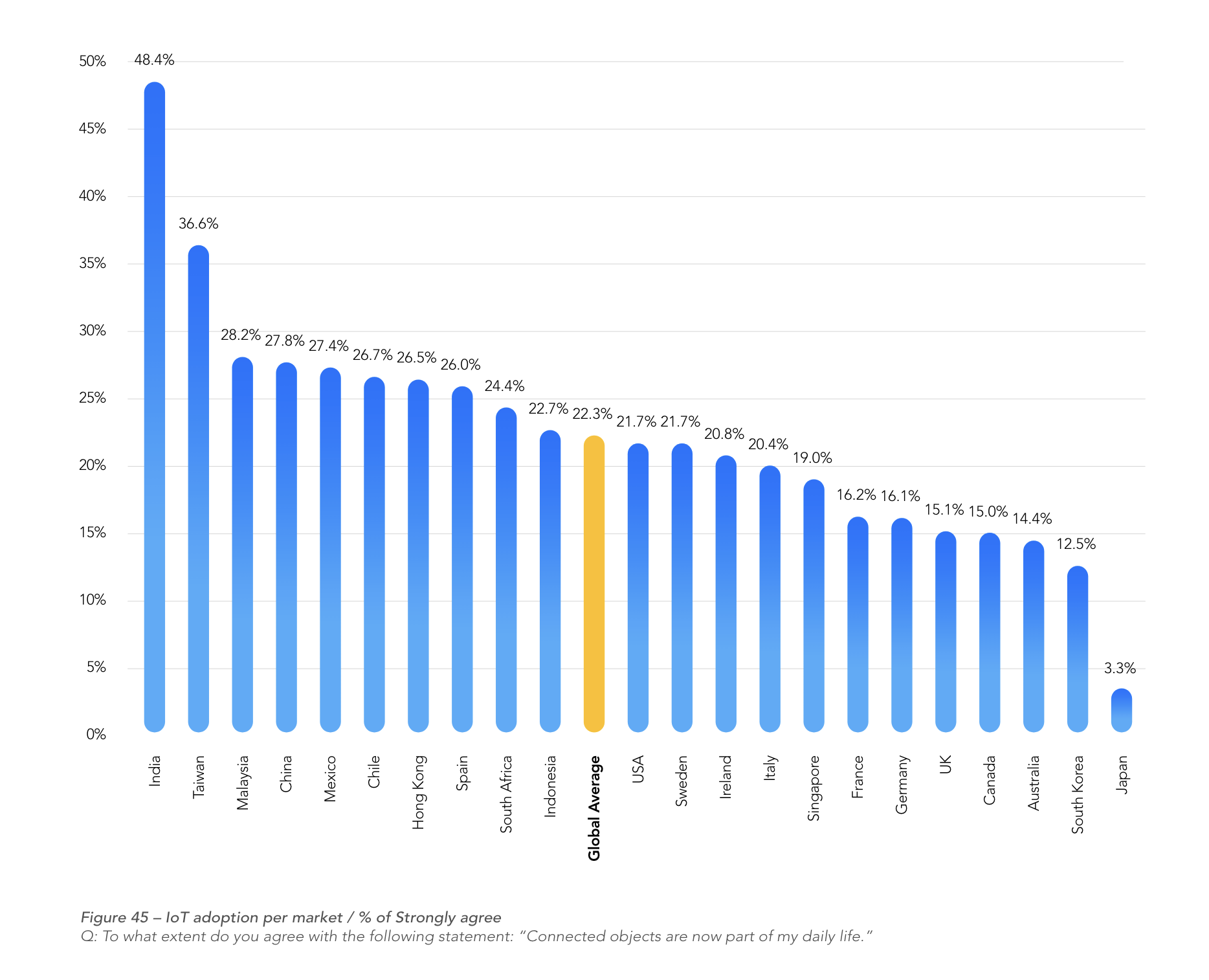

Figure 45 shows the responses by market where connected objects have made the biggest impact. Against a global average of 22.3% for strongly agree, India (48.4%) and Taiwan (36.6%) were the two markets where respondents were most strongly in agreement with the statement. Japan, at 3.3%, was the market with the lowest level of agreement with the statement, followed by South Korea (12.5%) and Australia (14.4%).

To keep pace, insurers need to update products regularly to keep up with everchanging needs and find a profitable route to grow. For example, embedding cyber insurance within these connected smart products, or providing it as part of the internet package, may provide an option for insurers looking to serve this market.

References

- SonicWall, 2022. CYBER THREAT REPORT. [online] SonicWall. Available at: <;. [Accessed 1 Sept 2022]

- Morgan, S., 2022. Top 6 Cybersecurity Predictions And Statistics For 2021 to 2025. [online] Cybercrime Magazine. Available at: <https://cybersecurityventures.... top-5-cybersecurity-facts-figures-predictions-and-statistics-for-2021-to-2025/> [Accessed 1 Sept 2022].

- Accenture, 2022. Three ways COVID-19 is changing insurance. [online] Available at: <; [Accessed 1 Sept 2022]

- Mordor Intelligence, 2022. Growth, Trends, COVID-19 Impact, and Forecasts (2022 - 2027). Internet of Things (IoT) Market. [online] Available at: <;. [Accessed 1 Sept 2022]