Purchasing insurance: it all starts close to home

To take a little poetic license with the sayings of Lau Tzu, every journey begins with a single step. What is it that makes policyholders take that initial step on the road to insurance purchase? We asked over 12,000 people from around the world in this year's Global Consumer Study...

-

#1 Recommendations from friends & family is the number one trigger for an insurance purchase.

Advice and distribution channels

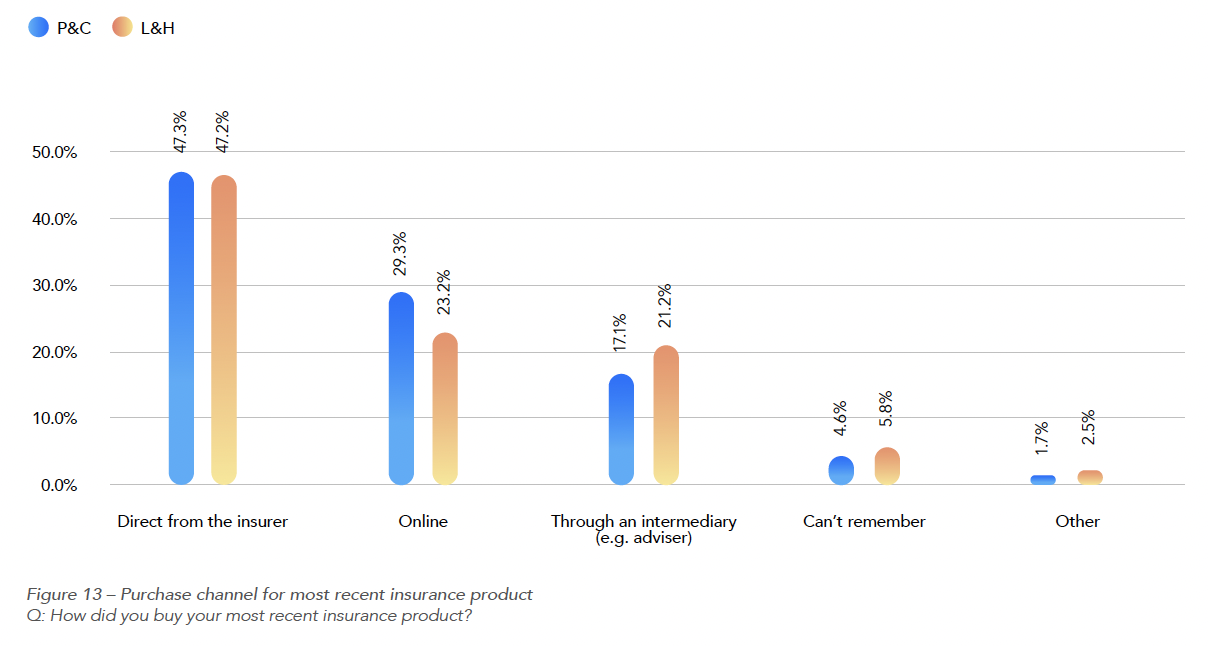

Whilst friends and family play a key role in setting policyholders on their purchase journey, consumers look to the professionals for advice. Over half of our respondents sought advice from insurance agents or independent financial advisers (52.3% for P&C and 56.1% for L&H).

First impressions count

One of the strange things about insurance is that those who buy it hope that they will not have to use it. Those that do claim will see the benefit long after – in the case of life insurance, perhaps many years after – they bought the cover. The experience that consumers receive during the purchase process serves as an indication – possibly the only indication that they will have – of the service they might expect in the event of a claim.

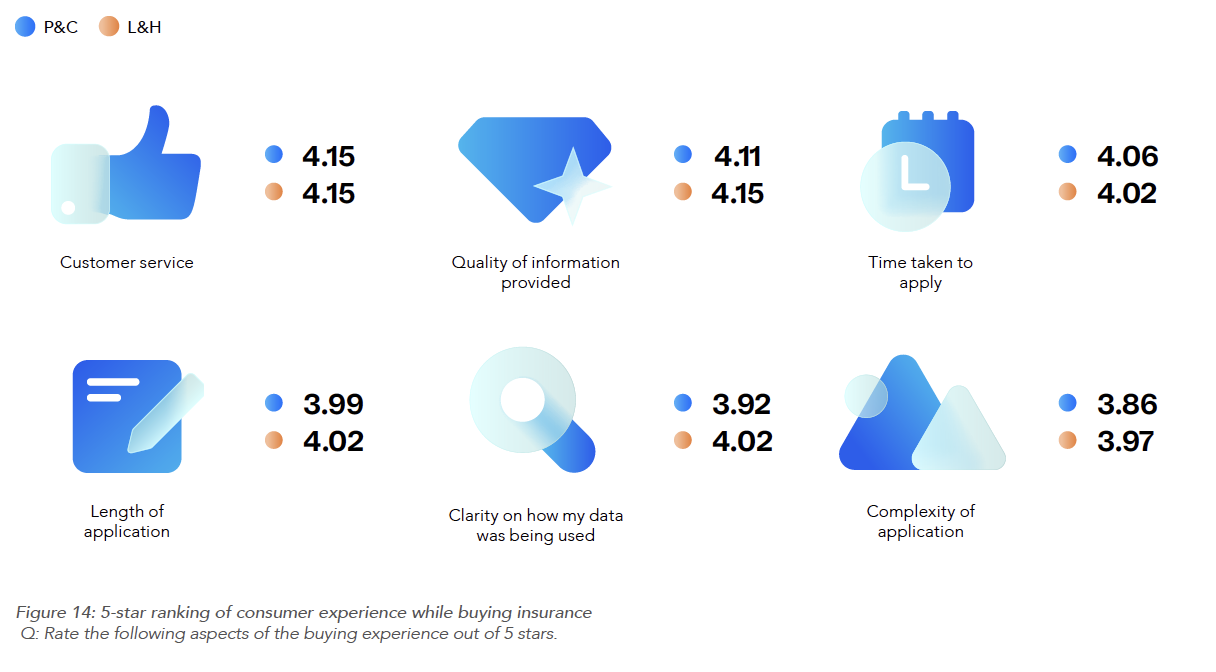

The abstract nature of an insurance product makes it all the more important that insurers create the right first impressions. Respondents who had taken out a policy in the past two years rated their experience of the insurance purchase process. Their views were sought on six different aspects of the process. From these responses we produced five-star rankings for each of the six areas for both P&C and L&H.

Although there are areas for improvement, these results should provide considerable comfort to insurers. Whether a customer is taking out cover or making a claim, the service they receive will shape their impressions of both the insurer and the product that they have purchased.

There is yet more positive news for insurers in the responses to a question about what actions consumers take on renewal of a policy. Although price comparison websites make it easy for customers to shop around, nearly half of respondents (45.8%) say they would continue with the same policy. There is no doubt that inertia plays a part but, nonetheless, this can be taken as a further sign of their satisfaction with the service provided by the incumbent insurer. Only one in five (21%) say they would consider products from other insurers.