Tailoring digital journeys for next-gen insurance consumers

-

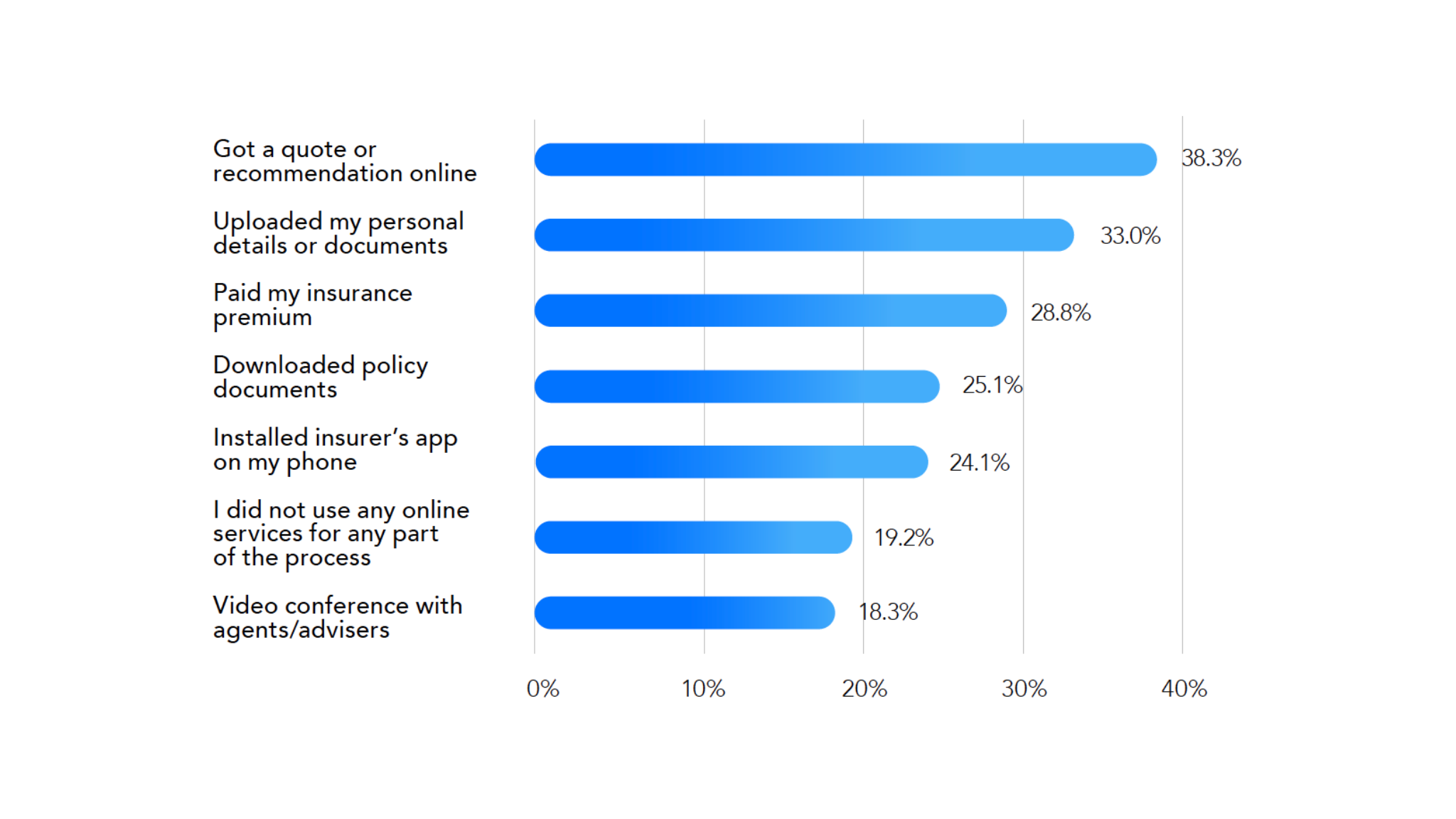

80.8% used online tools during their recent insurance purchase

Technology is changing the delivery of customer service and, indeed, shaping consumer expectations of customer service. But meeting the needs of a broad range of customers does mean that insurers must be sensitive to their preferences when introducing new technology. We sought consumers’ views of the use of technology at two key points in the insurance journey – purchase and claim.

Download the Global Consumer Study

Just 19.2% of respondents say that they had not used online services at any point in the purchase process (Figure 16). Online services are widely used for getting recommendations and quotations; for uploading information on application and, to a lesser extent, for paying premiums and in downloading policy documents.

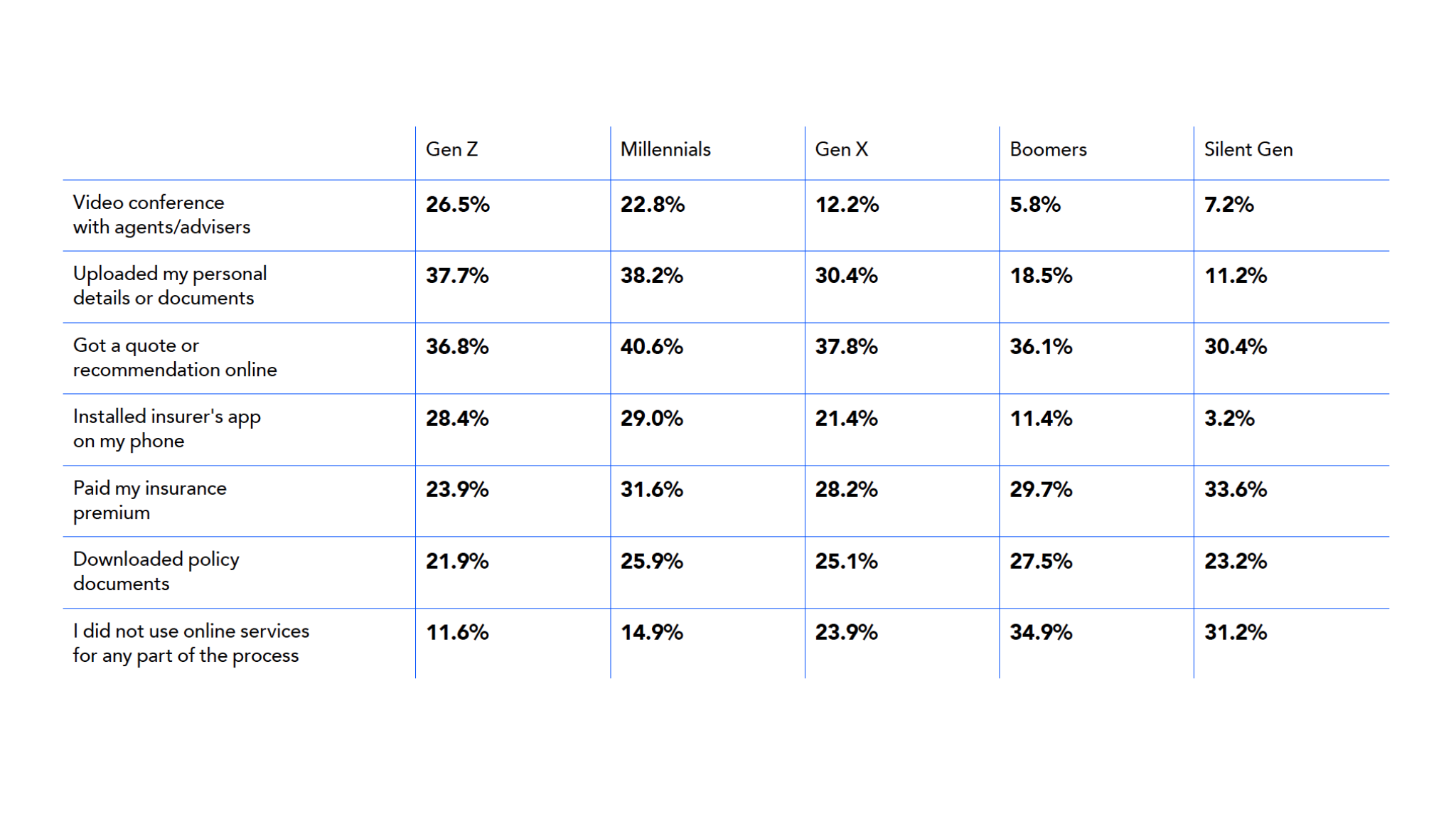

The use of these online services does vary by generation (Figure 17). Without surprise, younger generations are more switched on to the use of insurers’ apps – around 30% of Gen Z and Millennials but only 3.2% of the Silent Generation. And, whilst there is surprisingly little generational difference in those downloading policy documents, it appears that the younger generation are more comfortable in uploading documents and personal details – around 40% of Gen Z, Millennials and Gen X compared with just 11.2% of the Silent Generation.

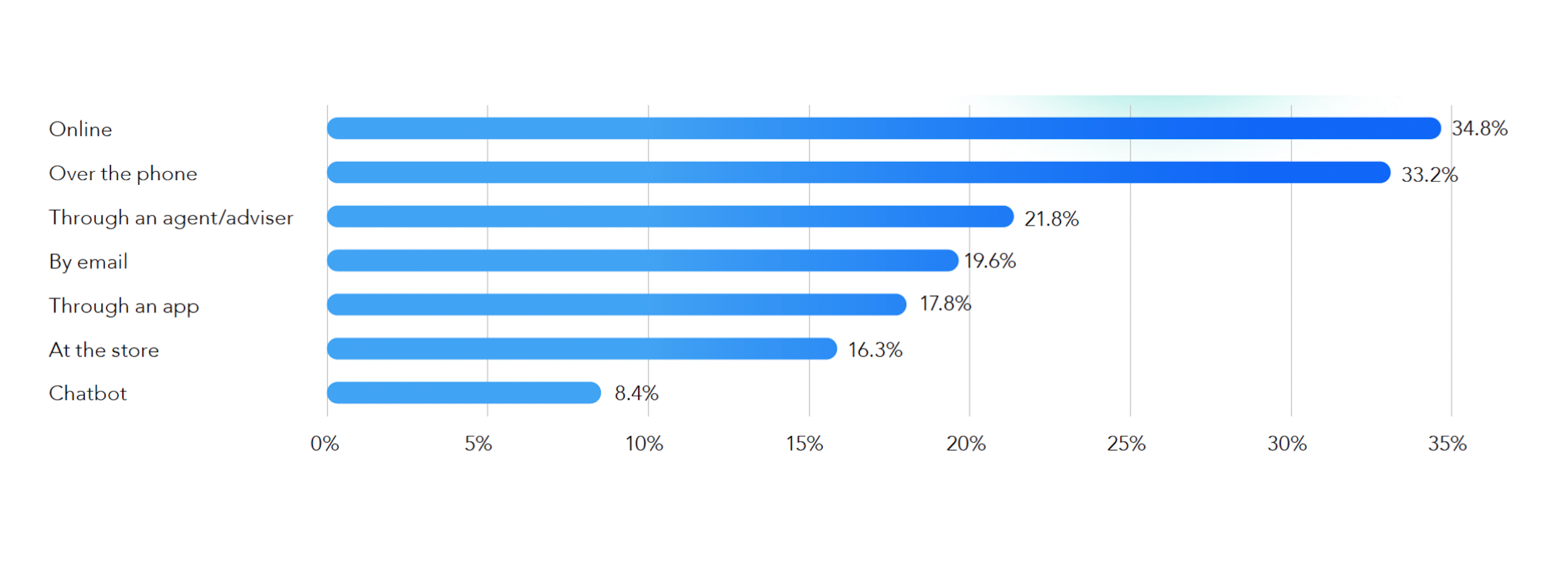

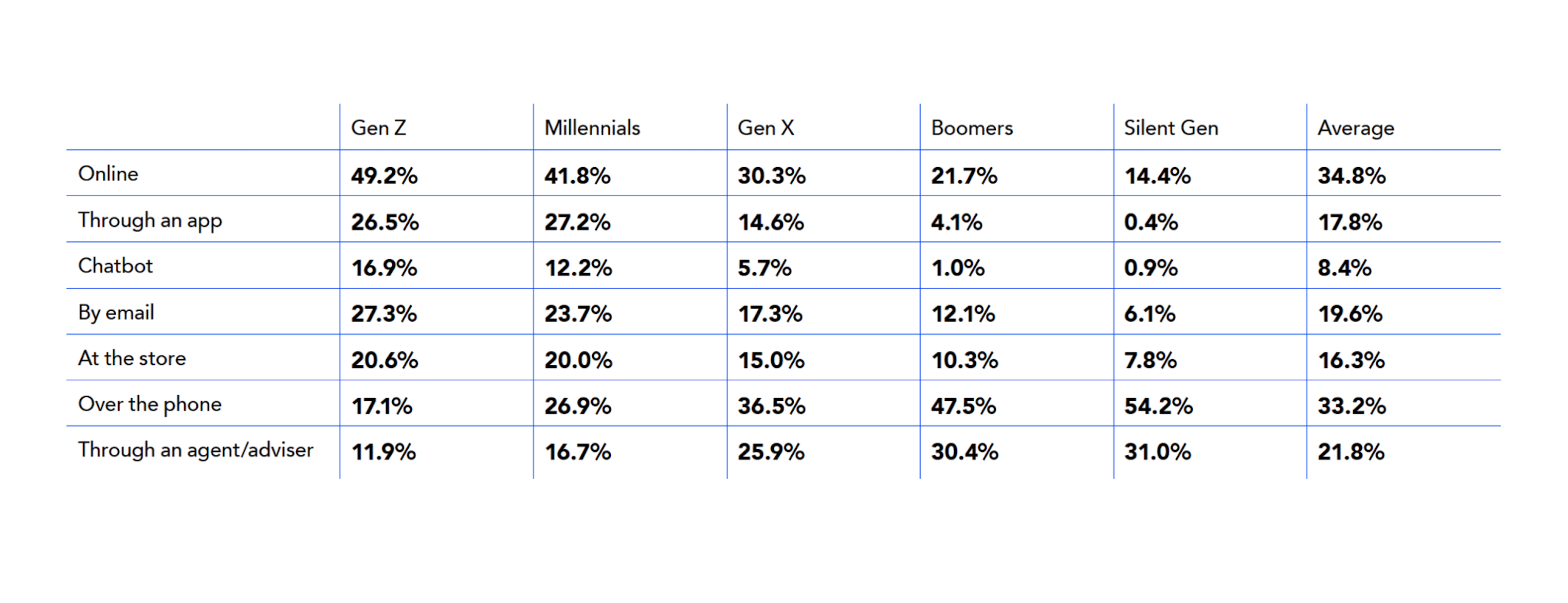

The most commonly cited avenues for making a claim are online (34.8%) and over the phone (33.2%). It is likely that these data are heavily weighted towards P&C claims, particularly amongst the younger claimants (Figure 18).

As one might expect, the take up of the more technology-based options is inversely correlated with age. Gen Z respondents were over three times more likely to use online claims services than those from the Silent Generation and over fifty times more likely to use an app (Figure 19).

Part of the reason for this is certainly down to the adoption and familiarity with technology. However, the different types of cover held by these two generations may also influence the way in which a claim is registered. While the older generations will be seeking protection for assets such as property, motor, and life insurance, it is more common for the younger generations to have products such as mobile phone insurance. A claim for a damaged or stolen mobile phone is relatively transactional, especially compared to one for a flood or fire at a property or a life insurance claim.