Living Well in a Connected World: Understanding health apps, data & insurance

-

69.9% of Gen Zs and Millennials regularly use, or are interested in using, health apps.

As the world grappled with the challenges of a global pandemic, technology emerged as a lifeline. Lockdowns and social distancing measures prompted individuals to seek solace in digital solutions. Health apps and wearable devices seem to gain prominence, reshaping the insurance landscape.

Amidst the tumultuous global pandemic, individuals sought solace in technology to bridge the gaps that emerged in their personal and professional lives from lockdowns and social distancing measures.

As the adoption of technology surged during these uncertain times, a notable trend that emerged, amongst others, was the increased utilisation of health apps and wearable devices. This shift in behaviour held substantial significance for life insurers, unveiling a fresh avenue to attract, engage, and retain insurance customers while simultaneously improving the well-being and welfare of policyholders.

With the pandemic slowly becoming a distant memory for most now, we’ve seen life insurers’ interest in the health and wellness space go from strength to strength. Insurers continue to launch their own wellness programmes, partner with key health industry players and invest in health-based start-ups.

For example, US insurer John Hancock recently unveiled a collaboration with ŌURA, the Finnish company behind the smart ring that offers personalised health information, activity insights and daily guidance. Through this partnership, eligible customers who possess an Oura Ring and active Oura membership can seamlessly integrate with the Vitality programme. By doing so, they can unlock a range of rewards for prioritising healthy sleep patterns and engaging in mindfulness practices, including meditation and breathing exercises.

This collaboration aims to empower individuals to take proactive steps towards enhancing their overall well-being while reaping the benefits of their commitment to healthy habits.

While such developments are reshaping the industry, the question remains as to whether Gen Zs and Millennials are captivated by this proposition, a proposition that insurers have invested so heavily in thus far.

Do young people care about health?

Across the last 4 years, we’ve been asking Millennials and Gen Zs how big a role healthy living plays in their life. Their response? It matters. Consistently, we’ve seen more than 60% tell us it has a "large" or "very large" part to play, with consumers in China (92%), Mexico (88.3%) and Chile (82.5%) attributing the most importance this year.

A curious outlier in our results is found in Japan. Despite having the world’s longest life expectancy, for almost half of Japanese respondents healthy living allegedly wasn’t too important (49.8% say it plays a “small role”). An explanation for this could be that because factors such as good diet and nutrition are so commonplace in the country, residents associate these activities with a “normal” life, rather than one which is unusually healthy.[1]

It is possible that the threshold for what is considered healthy in some markets like Japan may be wholly incompatible with other nations' ideas of wellbeing, and indicates we still have some way to go to develop a universal notion of a “healthy life”.

We should also be wary of getting too carried away with our positive results – on average, less than a fifth of respondents from Western markets in 2023 say health is really important to them – clearly leaving room for improvement.

So, what motivating factors could lead to an increase in the number of young people caring about getting in shape?

What gets you moving?

In this year’s GCS, we gave respondents a list of nine different possible motivators to accelerate their activity and asked them to indicate all measures which would prompt them to become fitter.

"Going to the gym" topped responses, with close to half of global respondents saying attending a gym would reap health benefits for them (47.7%). "Regular medical check-ups" (43.4%) and "encouragement from family and friends" (39.2%) were some of the other most popular stimuli for our audience.

Perhaps most encouragingly for a generation of digital natives though, is that our respondents considered "health & wellness apps" the second most effective method to improve their physical health (44.8%).

In fact, when asked about whether they used a health app regularly, nearly 70% of Millennials and Gen Zs said they either did or they were interested in doing so. The data show not much of a generational split here either, with a negligible (<1%) difference in the number of Millennials and Gen Zs who have a health app.

Mostly, people are discovering such apps through their own research (56.4%), but social media is also playing a big role in user acquisition. Nearly a quarter of respondents learn about health and wellness apps through social channels or influencers (23.2%), and with social media usage projected to rise by around 1 billion people by 2027[2], we are likely to see a rise in the number of young people discovering apps through Instagram, X (formerly Twitter) or TikTok in the coming years.

Health apps – what’s the buzz?

The main motivation for our respondents having health apps was, naturally, “to get healthier” – 65%, slightly down from last year’s 69.3%. Though noteworthy is the fact that a desire to "understand one’s body better" was also appealing (46.2%), followed by the need for an extra push (41.9% – motivation).

Perhaps most importantly for insurers is that only 11.7% of respondents globally said they had a health app because of the possibility of insurance discounts. Given that 89.7% of those considering installing a telematics device on their car are interested in doing so because of potential premium discounts, we know that such discounts are a driving factor in consumer behaviour generally.

So, why the difference when it comes to health? Is it one of exposure or desire? Well, it may be that consumers are simply less aware of the ability to obtain premium discounts through a health app – and that, therefore, insurers need to do a better job of advertising these schemes to their policyholders. But another factor is that the gap between young and old in car insurance costs is far more pronounced than in life insurance, making the discounts available here more of a priority to pursue.

How important are health apps to consumers?

Our data demonstrates significant usage of health apps by Millennials and Gen Zs. But are the apps sufficiently attractive to inspire young people to part with money, especially when comprehensive free versions of some of the most popular health apps – such as Strava – are commonly available on the market.

Well, it is a split picture. 45.2% say they would pay for premium versions of these apps if the features justified the cost, set against 47.1% who would not. The additional 7.8% are unsure on the subject and potentially could be swayed to pay for an enhanced service.

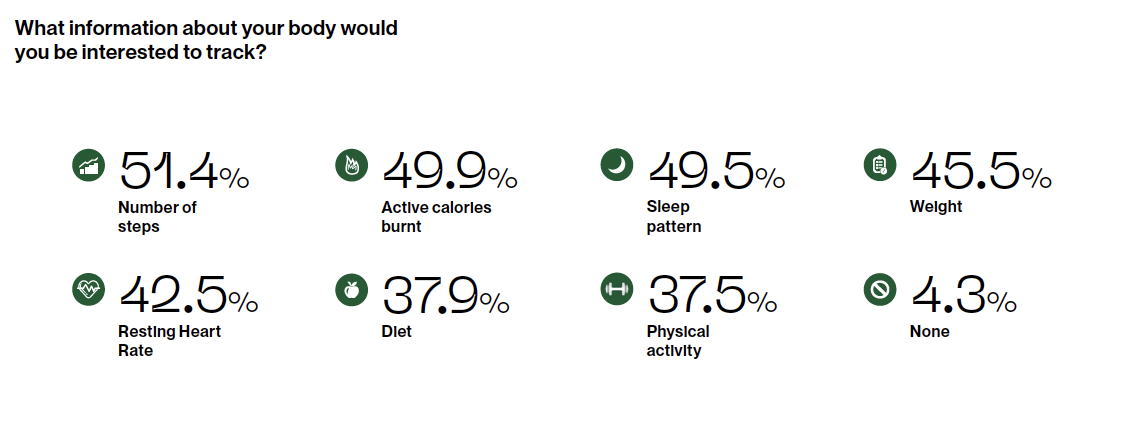

What, then, is the deciding factor? Our respondents this year told us the most important features for them to track on such an app are number of steps (51.4%), active calories burned (49.9%) and sleep pattern (45.9%). Our results from this question do show strong appetite for a range of other features, too, suggesting that insurers who consider exploring this avenue should provide features compatible with a holistic view of health.

Data exchange

As we know, offering a well-designed app that encourages policyholders to improve their lifestyle may deepen ties with customers and improve the risk pool. The data gathered can be used to customise cover and price, rewarding healthy behaviours with tailored pricing or product features that suit their needs. It can also inform underwriting, with the granularity of this data helping insurers to identify trends and patterns that could affect risk.

Innovation in this space is all well and good, but access to this data is dependent on customers feeling comfortable enough to share it. We explored the attitudes of Gen Zs and Millennials regarding this matter.

When asked which pieces of data they were comfortable sharing with their insurer, the majority say they are happy to share most types. While previous claims history (77.6%) was the information the highest percentage of people are comfortable or very comfortable sharing, health check-up related data also receives the green light.

Information that is already provided to insurers, for example health check-up data (75.5%) and medical or electronic health records (73.1%) was the health data people felt most comfortable sharing. However, 69.6% of respondents have no qualms also sharing wearable data.

The research also looked at attitudes to sharing optional data, for instance from a smart watch or car analytics device, to secure a customised insurance plan.

Some markets’ respondents are more switched on to this idea than others. In particular, India (78.3%), South Africa (75.7%) and China (69.7%) are most comfortable with this idea, while it is less compelling in Germany (37.9%), Japan (40%) and France (41.4%). However, these generations expect some benefit in return for their data.

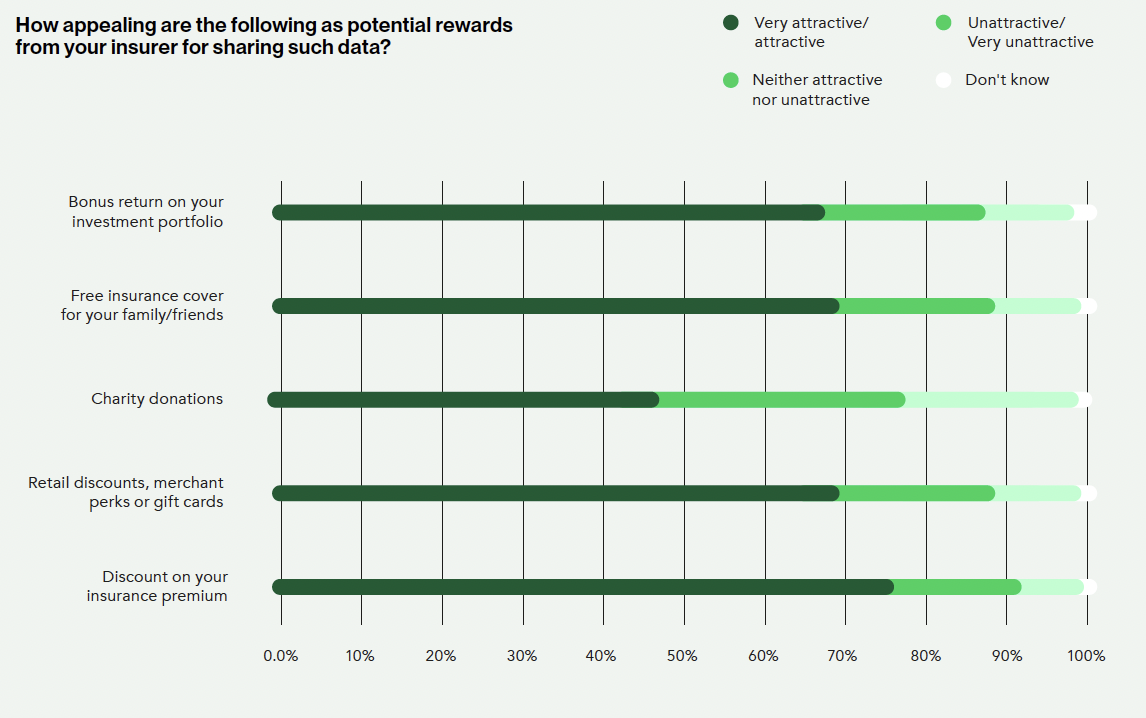

When asked how appealing different potential types of rewards were, a discount on the insurance premiums was most appealing.

Free insurance cover for family and friends came next, followed by retail discounts/gift cards close behind. Donations to charities were the least popular choice.

Overall, this demographic recognises the value of their data and the potential benefits of exchanging their personal health information in return for customised plans and incentives tailored to their specific needs and preferences.

For the record

Electronic Health Records (EHRs) are a digital version of a patient's medical history, that include information about their medical conditions, treatments, medications, allergies, etc. EHRs are designed to replace traditional paper-based medical records, offering several advantages such as improved accuracy and accessibility of patient information.

Over recent years, we have seen reinsurers, insurers and insurtechs show great interest in gaining access to such records. They hope it will allow them to maximise several benefits such as real time health updates, more accurate risk assessments, efficient claims processing, improved care coordination and fraud detection and prevention.

Recent examples of this include USAA Life partnering with Express Imaging Services, a provider of medical record retrieval and digital data solutions. This partnership will allow USAA Life to expedite the retrieval of member eHealth data and automate and streamline its underwriting process for its members.

With this phenomenon seemingly becoming more common, we asked our respondents two questions regarding the sharing of their most personal health information.

First, we asked if our respondents would be open to knowing from their insurer their risk of getting certain illnesses (like cancer, diabetes or a heart attack), if the insurer were given access to their health check-up information. 75.9% of Gen Zs and 71% of Millennials responded that they would be open to this.

Second, we asked of those who said yes, if they would be happy to follow advice from their insurer on how they can get healthier and reduce their risk of disease. A resounding 92.1% said they would.

Despite the extremely sensitive nature of EHRs, it appears our younger generations are comfortable in sharing their medical records with insurers and are open to hearing advice on how they can reduce their health risks. This is a great opportunity for insurers to foster deeper relationships with their policyholders whilst simultaneously streamlining their underwriting and claims processes.

Key Findings

- Nearly 70% (69.9%) of Millennials and Gen Zs report having a health app or were interested in getting one.

- Discounts on insurance premiums were the most appealing reward for sharing their wearable health data with their insurer. Free insurance cover for family and friends came next, followed by retail discounts/gift cards close behind.

- 72.8% of respondents are open to knowing from their insurer their risk of getting certain illnesses (like cancer, diabetes or a heart attack), if the insurer was given access to their health records.

References

[1] Tsugane, S. (2021). Why has Japan become the world’s most long-lived country: insights from a food and nutrition perspective. European Journal of Clinical Nutrition. 75, pp.912-928. [Online]. Available at: https://www.nature.com/article... [Accessed 21 August 2023].

[2] Dixon, S.J. (2023). Number of global social network users 2017-2027. [Online]. statista.com. Last Updated: 29 August 2023. Available at: https://www.statista.com/stati... number-of-worldwide-social-network-users/#:~:text=How%20m [Accessed 4 September 2023].