Why do people buy life insurance?

In this guest article, SCOR's Niamh Uí Cheallacháin and Octavian Roscascor look at the behavioural science behind the rapid increase in life insurance sales, especially over the last two years, and how everyday biases affect consumer decision making.

Life insurance: Bought not sold?

“Life insurance is sold, not bought” has been the conventional wisdom for decades, but extraordinary events such as a pandemic can overturn the old belief. COVID-19 has brought a rising life insurance sales trend in many parts of the world.

This trend was not in the initial prediction by many industry experts. Many thought, as SCOR Head of Client Solutions in the U.S. Mary Beth Ramsay wrote in her article, life insurance sales would decrease, due to the economic impacts of the pandemic prevention measures. But the reality has turned out to be the opposite.

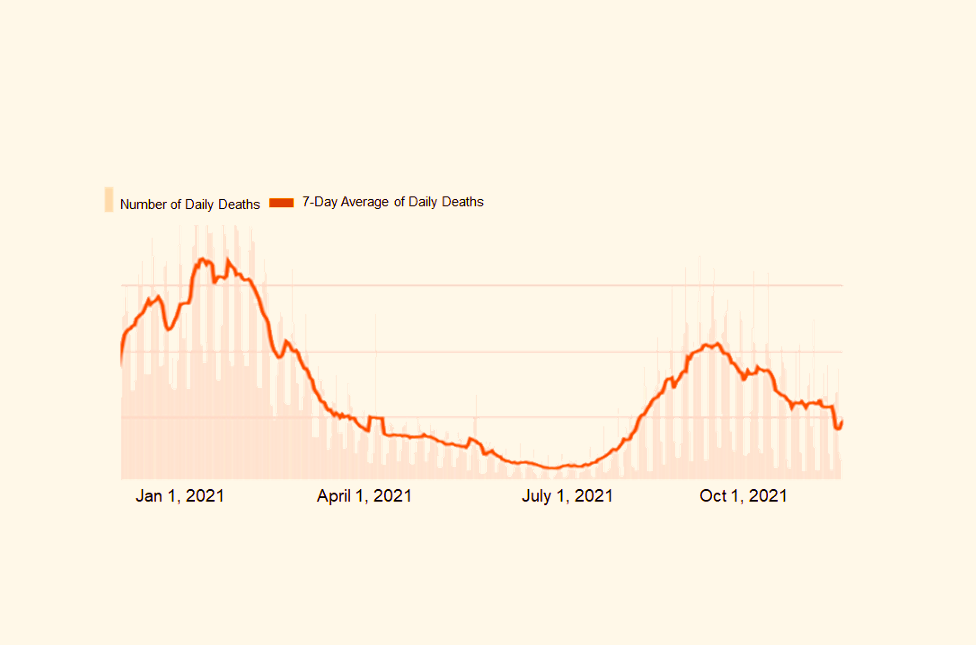

Number of U.S. COVID-19 daily deaths Jan – Dec 2021. Source: John Hopkins Coronavirus Resource Center

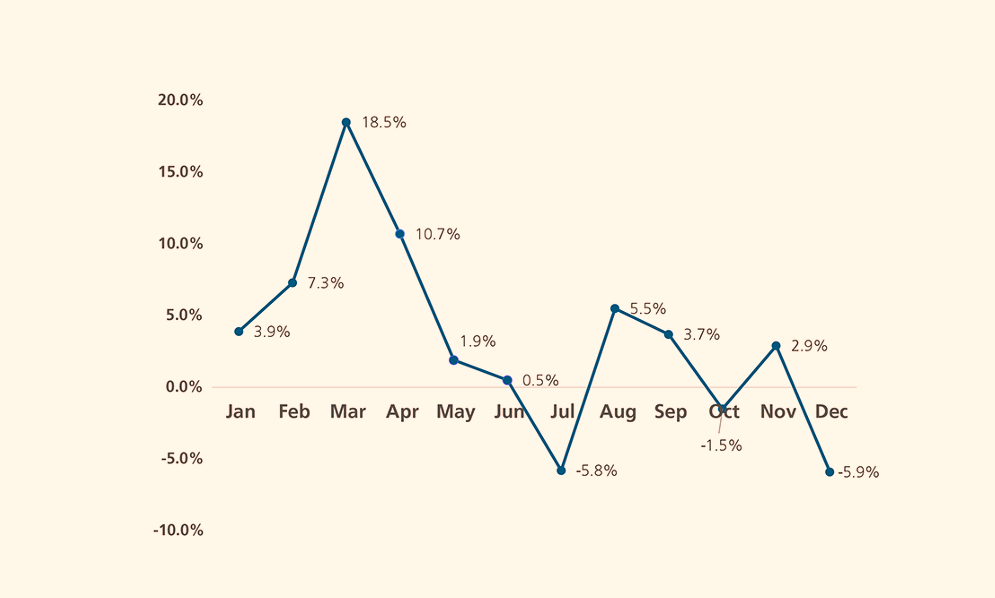

The charts above and below show the trend of COVID-19 death tolls and the growth of life insurance applications in the U.S. throughout 2021[1]. Life insurance applications increased dramatically, up to 18.5% in March, after the COVID-19 death toll hit a record high. Both went down in summer and picked up again in fall as COVID deaths resurged. The trend of those two separate factors seems to be somewhat correlated.

U.S. life insurance monthly applications. Source: MIB Life Index.

What's behind consumer behaviour?

How did that happen? Some say that the increased uncertainty and fear seem to have caused consumers to be more aware of the risks to health and life. That makes sense, but is there a scientific way to explain this phenomenon?

“Behavioural science can offer valuable insights and a key to understanding this historic trend as it explains how economic, social and psychological factors influence the way people make decisions,” says Niamh Uí Cheallacháin, SCOR’s Behavioural Science Associate. She suggests answers to the question through a behavioural science lens.

Understanding and assessing risk and selecting insurance products involves complex decision-making processes, which often deviates from the rational processes that traditional economic theory would suggest. Several behavioural patterns may help us understand this complex process and predict insurance purchase decisions. Behavioural biases are one of them.

Seven main behavioural biases

Seven major behavioural biases shown below are often at play in our assessment of risk and consequently in the insurance purchase decision making process[2]:

- Availability bias

- Optimism

- Overconfidence

- Present bias

- Default effect

- Loss aversion

- Illusion of control

Of all the behavioural biases described above, availability bias would be the best one to help explain the recent rise in consumers’ awareness of risk to life and health, says Niamh. Let us explore a little deeper.

Easy come, easy go

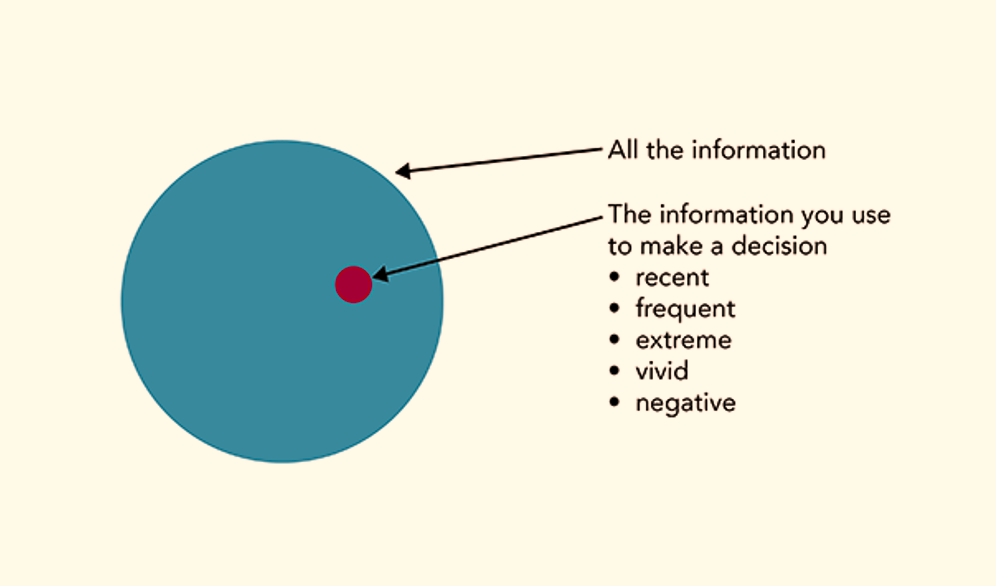

The availability bias is a distortion that arises from the use of information that most easily comes to mind, rather than that which is necessarily most representative. The illustration below gives you a visual guide on how availability heuristics, or mental shortcuts, influence our decision-making.

The availability bias.

We use heuristics on a day-to-day basis because our brains cannot possibly process all of the information available all the time. The availability heuristic[3] is one such mental shortcut.

In a classic illustration of the availability heuristic at play, a study by Kahneman and Tversky[4] found that twice as many people thought the letter k would occur more frequently at the beginning of words rather than in the third position of words in a typical piece of text. This happened because it is easier to think of words that start with a k. Studies also have shown that negative events such as losing money result in a greater physiological and cognitive reaction than making money[5].

Perception and awareness of what poses the most risk to us is therefore affected by how easy it is for us to imagine the risky event and the consequence of the risk. This leads to decision-making regarding what to do about mitigating the risk. Let’s see how this applies to insurance purchase behaviours.

Lessons fromHurricane Katrina

One notable example of this heuristic in action in insurance can be seen when Hurricane Katrina hit New Orleans. Between 2001 and 2009[6], the average sales of flood insurance policies were between 0% and 4% each year. In 2006, the year after Hurricane Katrina, however, the number shot up to 14.3%.

Another example of availability bias in insurance is long-term care (LTC) insurance. In Germany, adult children are responsible for the cost of LTC should their parents be unable to finance it[7]. A study found that parents have an increased demand for LTC insurance products if their adult children are more aware of the risks that LTC products cover.

Exposure to Covid = more aware of risk

The ongoing pandemic appears to have brought the fragility of life to people’s mind. The 2021 Global Consumer Study (GCS) conducted by ReMark found that COVID-19 has caused a shift in attitudes towards risk and the value of insurance, particularly for millennials[8].

The GCS survey asked respondents whether they believed COVID-19 had changed their attitude to risk and the value of insurance. The percentage of those who said yes was highest among those that had a family member or friend who died from COVID-19 (71.8%) and higher than average for those who had tested positive or knew someone who had tested positive (58.1%).

This could be a good example of how an event that is in the forefront of many people’s minds may have influenced people’s awareness of risk.

The heightened awareness of the risk is also reflected in actual insurance sales. The chart below shows a strong upward trend in U.S. life insurance sales in 2021, reaching a 31% growth in December[9].

US Individual life insurance sales growth. Source: LIMRA International

Elaine Tumicki, corporate vice president of LIMRA Insurance Product Research, believes that the pandemic has raised consumers’ awareness of the need for life insurance protection[10]. Behavioural science offers scientific explanations behind consumers thought process that triggered this phenomenon.

Wrapping up

Life insurance purchase decision-making is a complex process. Assessment of the risk being insured against is one of its key components. Behavioural science gives valuable perspectives, including several behavioural biases that can impact consumers’ risk assessment process.

The availability bias is particularly relevant as it explains how people tend to use information that most easily comes to mind rather than in a more balanced and comprehensive way.

There is good evidence to suggest that COVID-19 being ever present and top of mind has heightened people’s life risk awareness and increased their intent to buy life insurance. Will this increased awareness continue after the pandemic is behind us? That remains to be seen.

But it is certain that insurance companies who have truly learned and understand consumers’ thought processes and proactively applied a behavioural science approach to their business model will have a competitive edge in the upcoming post-pandemic world.

Download the full report here .

References

1. Johns Hopkins, Coronavirus Resource Center and MIB Life Index

2. Addressing Obstacles to Life Insurance Demand (genevaassociation.org)

3. The availability heuristic: Why your brain confuses "easy" with "true" - Kent Hendricks

4. Tversky, A., & Kahneman, D. (1973). Availability: A heuristic for judging frequency and probability. Cognitive psychology, 5(2), 207-232.

5. Baumeister, R. F., Bratslavsky, E., Finkenauer, C., & Vohs, K. D. (2001). Bad is stronger than good. Review of general psychology, 5(4), 323-370.

6. Michel‐Kerjan, E., Lemoyne de Forges, S., & Kunreuther, H. (2012). Policy tenure under the US national flood insurance program (NFIP). Risk Analysis: An International Journal, 32(4), 644-658.

7. Zhou-Richter, Tian and Browne, Mark J. and Gründl, Helmut, Don't They Care? Or, are They Just Unaware? Risk Perception and the Demand for Long-Term Care Insurance. Journal of Risk and Insurance, Vol. 77, No. 4, pp. 715-747, December 2010, Available at SSRN: https://ssrn.com/abstract=1709... or http://dx.doi.org/10.1111/j.15...

8. ReMark, Global Consumer Study 2021-2022 https://cdn.remarkgroup.com/gc...

9. LIMRA (2021). U.S. Monthly Individual Life Insurance Sales

1. LIMRA: U.S. Life Insurance Policy Sales Increase 2% in 2020